STOP paying high payment processing fees… forever!

Our proprietary technology harnesses consumer behavior and industry strategy while cutting payment costs between 50 - 90% over traditional providers like Stripe, PayPal, Square and Authorize.net

A few client results, by the numbers

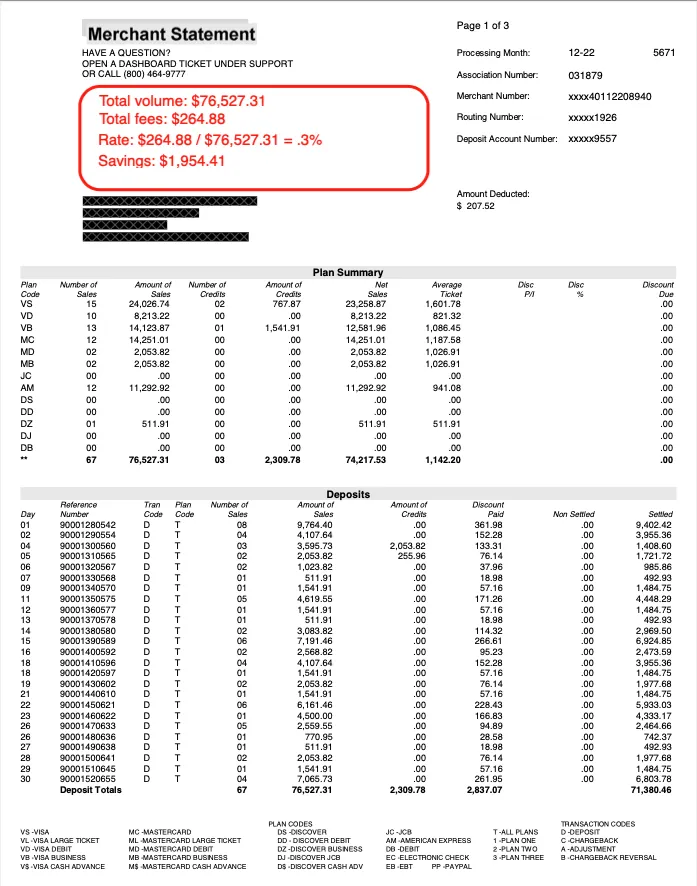

Real Estate

Lead Gen

Monthly Volume: $76,527.31

Total Fees: $264.88

Effective Rate: .30%

Total Saved: $1,954.41

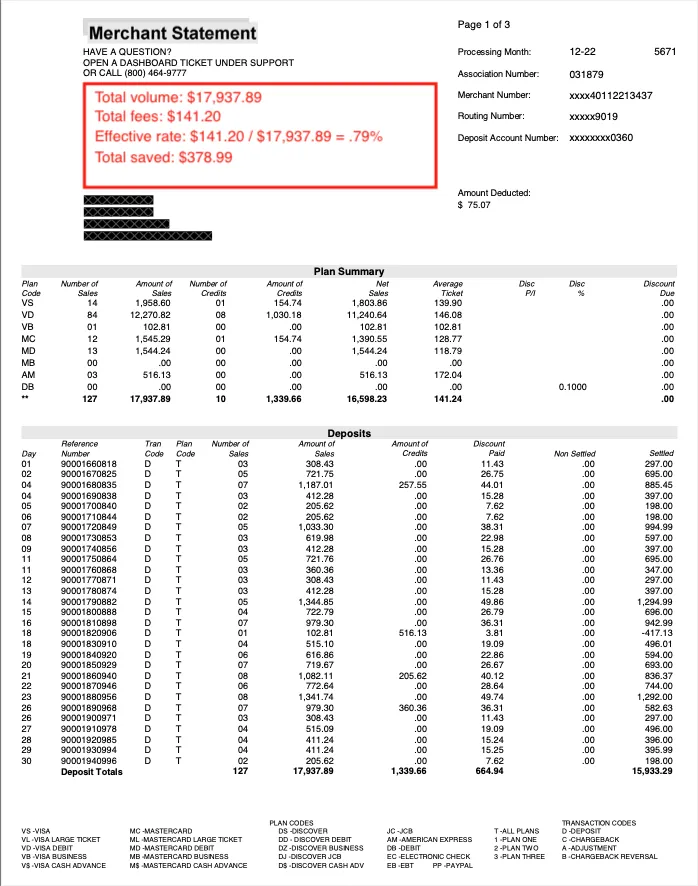

Credit Repair

Monthly Volume: $17,937.89

Total Fees: $141.20

Effective Rate: .79%

Total Saved: $378.99

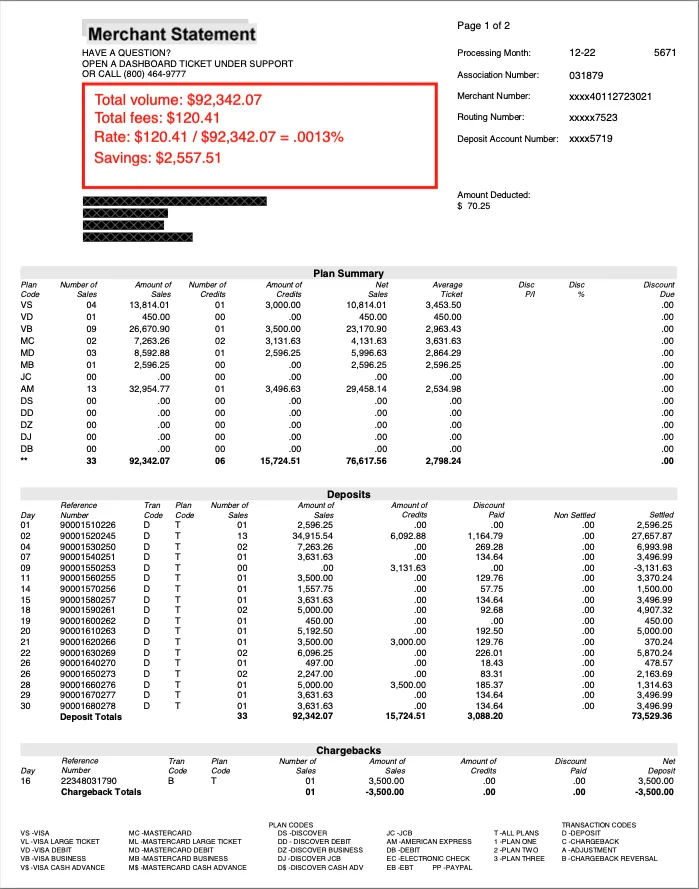

FA Marketing Agency

Monthly Volume: $92,342.07

Total Fees: $120.41

Effective Rate: .13%

Total Saved: $2,557.41

Non-Profit

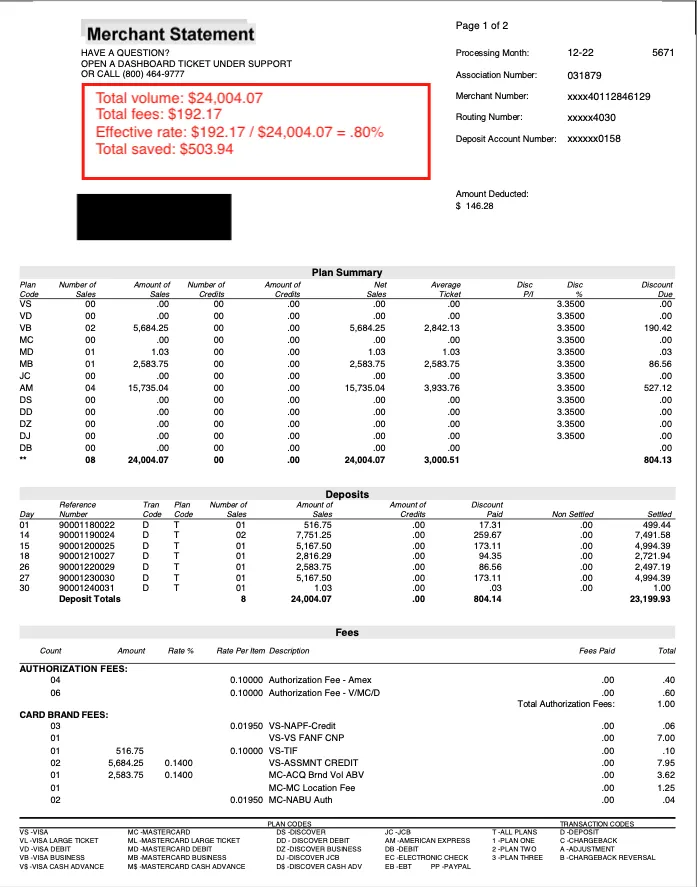

Life Sciences

Monthly Volume: $24,004.07

Total Fees: $192.17

Effective Rate: .80%

Total Saved: $503.94

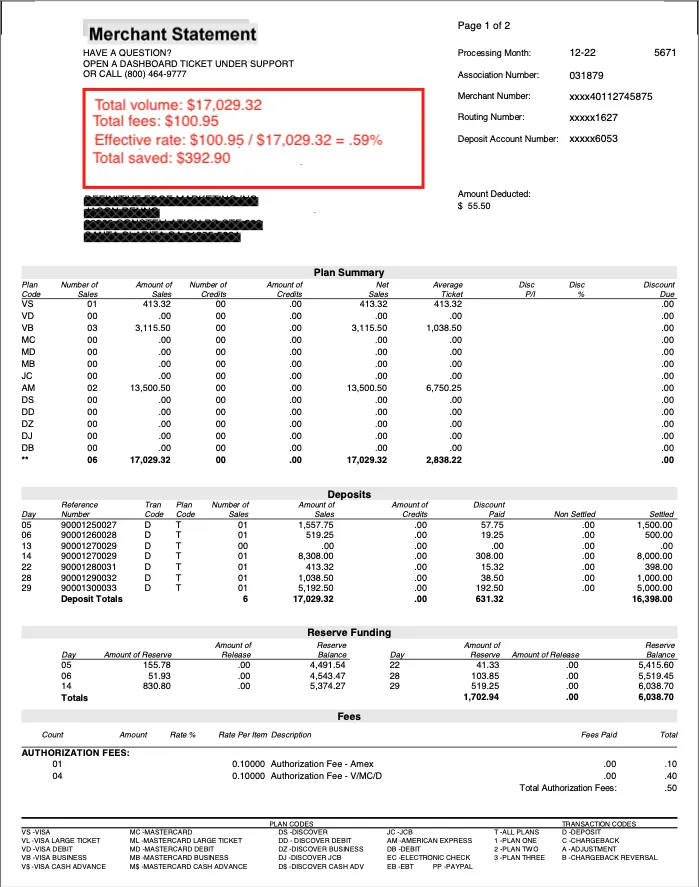

AI Marketing Agency

Monthly Volume: $17,029.32

Total Fees: $100.95

Effective Rate: .59%

Total Saved: $392.90

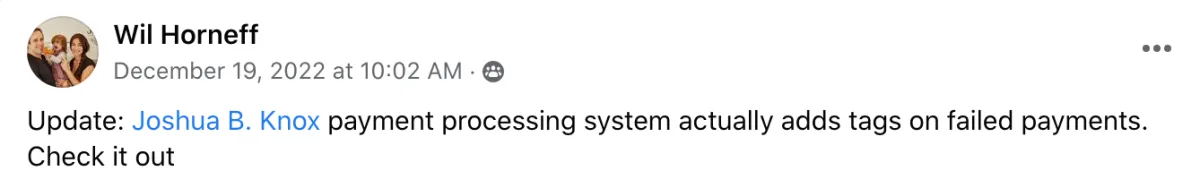

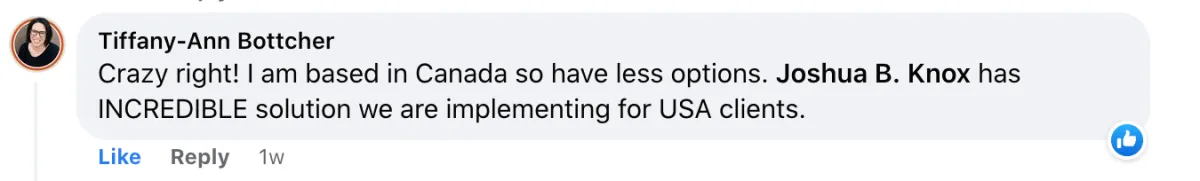

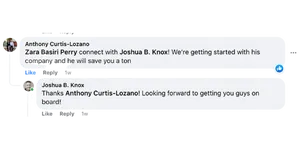

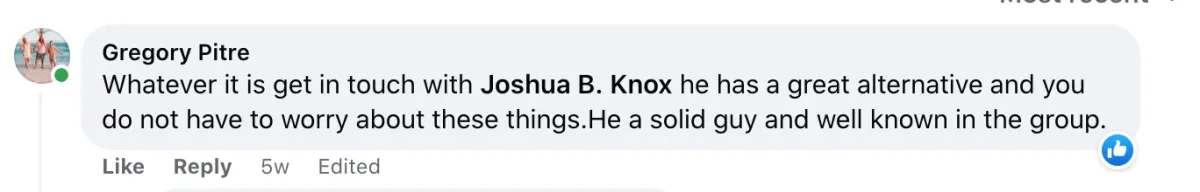

Client and community reactions...

What people are saying when asked about payment solutions

How it works

Payment Process

In this video we show you how to create a product, add it to a payment form and add the payment form to a funnel page, and finally, what happens when a customer pays

Send an Invoice

In this video we show you how to create an invoice, add a template to send it to your customer and then how it looks when your customer pays

Launch a SaaS

In this video we show you how you can create and sell a SaaS product and launch the sub-account for your clients.

Additional Features

Accept Credit Cards

Accept ACH

Send Quotes

Offer Free Trials

White Label

One Time Products

Cart Mode

One Time Coupons

Recurring Coupons

Hosted Payment Forms

Integrated Payment Forms

Member Portal

Recurring Products

Signatures on Invoices

Manage Subscriptions

Manage Purchases

Tag Payment Forms

Tag Products

Update Payment Details

Charge Setup Fees

T&C on Invoices

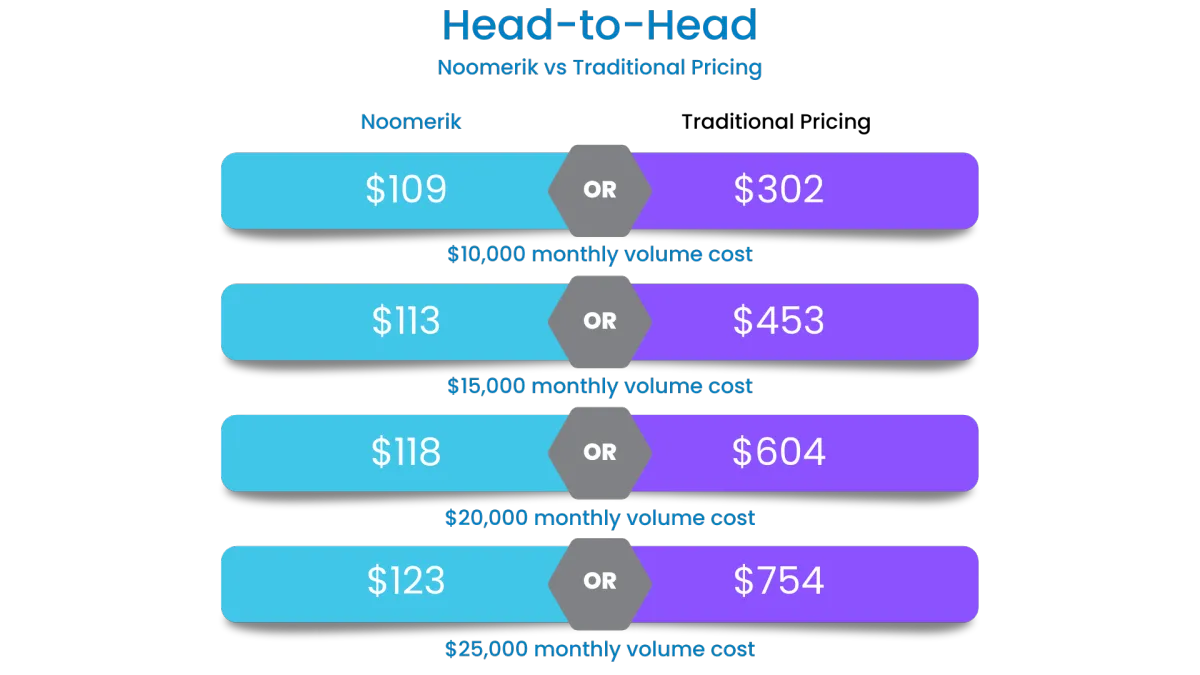

Pricing Plans

Dual Pricing Technology

Lowest Cost

Your average monthly cost for $10,000 in processing volume :

$115+

Rate = 1.15%

Details:

- $15/mo credit card merchant account

- $20/mo ACH or eCheck merchant account

- $44/mo Noomerik gateway and GHL integration

- 0% CC rate and just $.15 per transaction

- 1-1.5% + $.25 for ACH

Traditional Pricing Technology

Highest Cost

Your Average monthly cost for $10,000 in processing volume :

$325+

Rate = 3.25%

Details:

$15/mo credit card merchant account

$20/mo ACH or eCheck merchant account

$44/mo Noomerik gateway and GHL integration

Rates starting at 2.5% + $.20

Frequently Asked Questions

How Does It Work?

Our payment technology dynamically offers two different price points, a credit card and check price point. The check price point is slightly less than the credit card price point. The customer will always have a choice on how they want to pay and when they do they will always choose what's best for them.

How do I set up an account?

Click the Get Started button on this page and you'll be directed to a form to get started.

Do customers get upset about the fee?

It’s impossible to make everyone happy 100% of the time. However, in our experience when customers are given a choice, between a check or credit card, and one choice doesn’t have any fees they will still ALWAYS choose what’s best for them. And you’ll find they still choose to pay with a card 98% of the time because they want their rewards points, miles and cash back.

How long does it take to get a merchant account?

Generally speaking 3-5 business days. We find that the clients who get approved the fastest fill out the application in one sitting and submit all of their documents at the same time. We also find them to be approved faster when they are responsive to the underwriters additional requests.

Copyright 2021 Noomerik. All Rights Reserved